- Home

- Uncategorized

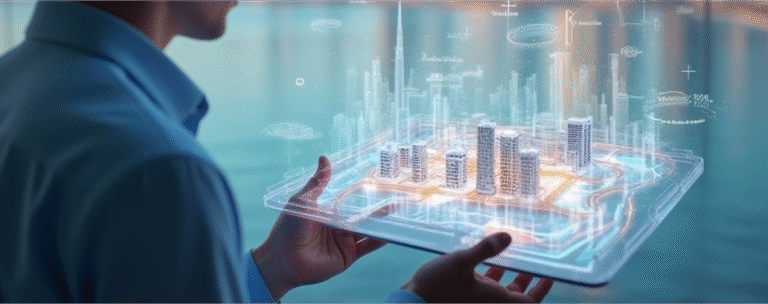

- Beginner’s Guide to Dubai Real Estate Investment

Beginner's Guide: Who Is Going to Invest in Property?

Exploring international real estate markets can feel overwhelming—particularly for those making their first investment abroad. If you’re wondering how to buy property in Dubai from India, this guide is crafted just for you. It simplifies the investment journey and helps new investors understand key considerations, risks, and steps to avoid costly mistakes.

1. Define the Purpose of Your Investment

Before you begin looking at listings, clearly define your investment objective:

- Is it for generating rental income or personal use?

- Are you seeking short-term gains or long-term value?

Knowing your goals will help you determine whether to pursue the best real estate investment in Dubai or a lifestyle-driven property for your family.

2. Plan Your Budget with Exchange Rates in Consideration

For Indian investors, understanding currency value is crucial. Your budget should account for:

- Down payment (20–25% of property value)

- Registration fees (typically 4%)

- Ongoing service and maintenance charges

- Indian residents can legally remit up to USD 250,000 abroad per financial year under the Liberalised Remittance Scheme (LRS). This makes it fully legal to buy property in Dubai from India for investment purposes.

3. Partner with Trusted Agents and Developers

First-time investors often wonder, can I buy property in Dubai from India without visiting? Yes—you can make an investment remotely. But the key is working with experienced and RERA-certified agents who can offer complete support from property selection to documentation.

Check curated investment listings through Alfa Orbit Real Estate for verified and safe options.

4. Focus on Freehold Zones for Better ROI

Foreign investors can only purchase in designated freehold zones where they get full ownership. Popular areas like Dubai Marina, Business Bay, and Downtown Dubai offer some of the best real estate investment in Dubai, especially for rental yields and value appreciation.

5. Legal Checklist for Smooth Investing

When you're exploring how to invest in Dubai real estate, ensure you have the following ready:

- Valid passport

- Proof of funds or income

- Signed MoU (Memorandum of Understanding)

- No Objection Certificate (NOC) from developer

- Title deed post-registration

Why Dubai Is a Hotspot for Indian Investors

Over the years, Dubai has transformed into a real estate hub for global investors, especially those from India. With over 3.5 million Indians living in the UAE, familiarity with the market, no currency restriction on investment, and high rental returns make it an attractive option. When exploring the best real estate investment in Dubai, investors often look for properties in areas like Downtown Dubai, Dubai Marina, and Business Bay for their strong appreciation and rental potential.

Can I Buy Property in Dubai from India? Absolutely.

Yes, and it’s perfectly legal. Foreigners, including Indian nationals, can buy property in freehold areas of Dubai, where they gain complete ownership of the property and the land it stands on. The UAE government has simplified the process to make the investment journey seamless.

Still wondering, can I buy property in Dubai from India? Not only is it possible, but thousands of Indian investors have already done it successfully.

To start, you’ll need:

- Valid passport

- Proof of funds

- A Dubai-based real estate agent or consultant

- An understanding of the local property laws

- You can explore a trusted property consultant through our professional property listing services to make the buying process smoother and safer.

Understanding the Dubai Real Estate Investment Landscape

Before diving in, take time to understand the different types of properties available:

-

Off-plan properties

Bought before completion, offering lower prices and flexible payment plans. -

Ready-to-move-in properties

Allow for immediate occupancy but typically come at a higher cost. -

Commercial spaces

High returns but with slightly more regulations and due diligence.

The good news is that Dubai real estate investment caters to all budget types, whether you're a first-time buyer or a seasoned investor.

Step-by-Step Breakdown for Investing in Dubai Property from India

Thinking of investing in Dubai’s booming property market? Here’s a step-by-step guide tailored for Indian investors to ensure a smart, secure, and profitable real estate investment. Let’s break down the exact steps involved in how to buy property in Dubai from India:

1. Choose the Right Property

Choose between an apartment, a villa, or a commercial property based on your investment goals. Refer to verified platforms or local agents who have a strong presence, like those listed on Alfa Orbit Real Estate.

2. Hire a RERA-Certified Agent

A real estate consultant licensed by RERA guarantees legal clarity and safeguards your interests throughout the transaction.

3. Sign the MoU

After finalizing the price, both the buyer and seller sign a Memorandum of Understanding (MoU), followed by a standard deposit payment of around 10%.

4. Apply for NOC

The developer provides a No Objection Certificate (NOC) confirming that all outstanding payments have been settled.

5. Final Transfer

Visit the Dubai Land Department (DLD) to register the sale and receive your title deed.

Following this sequence helps ensure that your process of how to buy property in Dubai from India remains smooth and secure.

How to Invest in Dubai Real Estate Without Moving Abroad

If you're asking how to invest in Dubai real estate without physically being there, rest assured—remote investments are possible. You can:

- Appoint a Power of Attorney in Dubai

- Use online portals and video calls for property tours

- Transfer funds through legal banking channels

- Sign documents digitally (or courier signed originals)

- For Indian investors, Dubai offers an open gateway. With zero property tax and high yields, the decision to buy property in Dubai makes even more financial sense.

Legal Requirements for Indian Buyers

- When considering how to buy property in Dubai from India, it's vital to stay updated on RBI guidelines:

- Indians can remit up to USD 250,000 per financial year under the Liberalised Remittance Scheme (LRS).

- Funds should be transferred through authorized banks with full documentation.

- No special permission is required unless it exceeds the LRS limit.

- So, if you're still asking, can I buy property in Dubai from India, the answer remains a confident yes—if you adhere to the legal frameworks and work with reliable agents.

Exploring the Best Real Estate Investment in Dubai: Top Areas to Watch

The best real estate investment in Dubai often depends on your goals—capital appreciation, rental income, or long-term security. Here are top-performing areas:

-

Dubai Marina

Great for high rental yields and waterfront living -

Downtown Dubai

Premium pricing with strong resale value -

Jumeirah Village Circle (JVC)

Affordable for first-time investors -

Business Bay

Perfect for business properties and short-term lease opportunities.

Why Indians Are Investing in Dubai Now More Than Ever

Post-Expo 2020 and with the introduction of long-term visas, Indian investors are eyeing the region with renewed interest. Here’s why:

- No property tax

- High demand for rentals

- Strong currency conversion benefits

- Ease of doing business

- With expert guidance, how to invest in Dubai real estate becomes a straightforward and profitable process. Start small and scale as you understand the market.

Advantages of Purchasing Real Estate in Dubai from India

Still deciding can I buy property in Dubai from India? Here’s what you gain:

- 100% ownership in freehold areas

- Residence visa for properties above AED 750,000

- Safe legal framework and digital access to property records

- Attractive returns compared to Indian metro cities

- These measures help safeguard your funds during the entire transaction process.

Final Thoughts: Your Guide to Profitable Investment

Whether your goal is a vacation home, long-term rental income, or simply diversifying your portfolio, Dubai makes for an ideal option. Knowing how to buy property in Dubai from India and working with trusted consultants will help reduce risks and improve outcomes.

With a range of developments and flexible payment plans, even first-time investors can tap into buying property in Dubai without the hassle. It’s no longer a question of whether I can buy property in Dubai from India, but how soon you can make it happen.