- Home

- Uncategorized

- Why Indians Are Investing in Dubai Property in 2025

Why More Indians Are Investing in Dubai Real Estate in 2025

Introduction – The Growing Dubai-India Property Connection

Dubai has always been a hotspot for tourism, luxury, and business. But in recent years, there’s been a noticeable surge in the number of Indian investors buying properties in Dubai. From stunning villas to high-rise apartments, the Dubai real estate market has caught the eye of thousands of Indian families and investors looking to grow their wealth and secure a slice of international luxury living.

Dubai: A New Real Estate Frontier for Indian Investors

With the UAE being home to over 3.5 million Indians, the emotional and financial connection between India and Dubai runs deep. Whether it’s for a vacation home, rental income, or future migration, Dubai is ticking all the right boxes for Indian buyers.

The Rising Trend: Why Now?

Let’s be real — property prices in India’s major cities are skyrocketing, and yields often don’t justify the cost. In contrast, Dubai offers tax-free income, modern infrastructure, and a cosmopolitan lifestyle — all at a relatively lower cost per square foot than places like Mumbai or Delhi.

Major Reasons Indians Are Choosing to Invest in Dubai

Tax-Free Returns and Investor-Friendly Policies

Dubai’s 0% income tax and no capital gains tax make it a paradise for investors. Imagine earning rental income without sharing a big chunk with the government — that’s what Dubai offers.

High ROI in Prime Dubai Locations

Areas like Downtown Dubai and Business Bay offer ROI of 6-9%, which is significantly higher than the 2-3% you might see in Indian metros. This makes Dubai a profitable and stable market for long-term investment.

Transparent Legal Framework and Easy Buying Process

The Dubai Land Department (DLD) ensures a smooth and secure transaction process. For Indian investors, this transparency is a breath of fresh air compared to the complexities often faced back home.

Luxurious Lifestyle at Affordable Prices

Where else can you own a luxury waterfront apartment with Burj Khalifa views for less than what you'd pay for a 2BHK in South Mumbai?

Global Connectivity and Accessibility

With multiple daily flights from Indian cities to Dubai, it’s practically next door. Whether it’s a weekend getaway or a business trip, you’re always just a few hours away.

Best Areas in Dubai for Indian Property Buyers

If you’re exploring Dubai Property Investment and trying to figure out how to save tax by investing in property, this comparison should make things crystal clear. Dubai offers long-term returns without slicing off portions through taxation.

Who Should Consider Tax-Free Real Estate Investing in Dubai?

Dubai Marina – For High-End Apartments

A favorite among young professionals and NRIs, Dubai Marina offers stunning views, nightlife, and excellent rental returns.

Downtown Dubai – For Luxury and Business Access

If you want to live next to the Burj Khalifa or rent out to corporate tenants, Downtown is the place to be.

Jumeirah Village Circle (JVC) – Affordable and Family-Friendly

A hidden gem, JVC is becoming increasingly popular among first-time Indian investors due to its affordability and community vibes.

Palm Jumeirah – Iconic and Prestigious Investment

For those looking for prestige and exclusivity, Palm Jumeirah offers iconic villas and waterfront apartments that hold their value incredibly well.

Villas or Apartments – What Should Indians Choose?

Why Villas Are Ideal for Long-Term Family Living

Many Indian families prefer villas for privacy, space, and the potential to host guests — all in line with Indian cultural values.

Why Apartments Are Great for Rental Income

Apartments, especially in central areas, are easy to rent out and manage. They’re perfect for investors who want steady passive income without the hassle.

Step-by-Step Guide for Indians Buying Property in Dubai

Eligibility and Required Documents

You don’t need UAE residency to buy property. Just have your passport, visa (tourist is fine), and proof of funds.

Working with a Trusted Real Estate Agency like Alfa Orbit

Alfa Orbit Real Estate simplifies the process with dedicated support for Indian clients, including virtual tours, documentation, and legal verification.

Understanding Off-Plan vs Ready Properties

Off-plan properties are great for capital appreciation, while ready-to-move homes generate immediate rental income. Your choice depends on your goals.

Getting a Mortgage in Dubai as a Non-Resident

Indian buyers can get up to 50% financing from UAE banks. Alfa Orbit can connect you with mortgage brokers who understand Indian financial documentation.

Legal Aspects and Regulations Indians Should Know

Freehold vs Leasehold Zones

Stick to freehold areas where foreigners can own property outright. Popular zones include Marina, JVC, and Downtown.

Title Deed and Ownership Transfer Process

The process is fully digital and fast — you can get your title deed within days if everything’s in order.

RERA Registration and Broker Verification

Always deal with RERA-certified agents like those at Alfa Orbit to avoid scams and ensure secure transactions.

Dubai vs Indian Real Estate Market – Key Differences

Capital Appreciation and Rental Yields

Dubai’s market is built for international investors, with better yields and appreciation potential.

Ease of Doing Transactions

From digital payments to e-title deeds, Dubai makes it simple — no more chasing brokers for paperwork!

Investment Safety and Transparency

Government regulation and a strong legal framework ensure your investment is protected.

Upcoming Real Estate Trends in Dubai for 2025

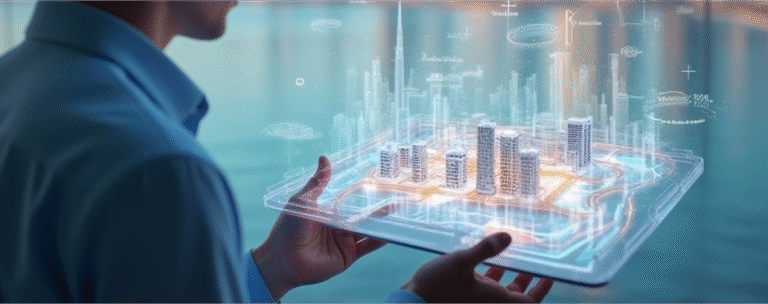

Smart Homes and AI-Enabled Apartments

Dubai is leading in smart technology — voice-activated systems, AI-controlled lighting, and energy-efficient homes are now the norm.

Sustainability and Green Living Communities

Eco-conscious developments are growing in popularity, especially among Indian buyers looking for future-ready homes.

Alfa Orbit vs Other Real Estate Agencies: Why Indians Prefer Alfa Orbit

| Feature | Alfa Orbit Real Estate | Other Agencies |

|---|---|---|

| Dedicated Indian Client Support | ✔ Bilingual agents, India-focused services | ✘ Limited understanding of Indian market |

| Virtual Property Tours | ✔ Available with personalized WhatsApp/Zoom walkthroughs | ✘ Rare or low-quality video calls |

| Legal & Documentation Assistance | ✔ Full support with UAE laws + Indian compliance | ✘ Minimal help, third-party legal support only |

| RERA-Certified Agents | ✔ 100% certified and experienced | ⚠ Not always verified or experienced |

| Access to Off-Plan & Exclusive Properties | ✔ Developer partnerships with exclusive offers | ✘ Limited access to premium listings |

| Customized Investment Plans for NRIs | ✔ Tailored options based on ROI, visa goals, etc. | ✘ One-size-fits-all recommendations |

| Post-Sale Support (Property Management) | ✔ Yes – Includes rent management, resale, furnishing | ✘ Ends after the sale |

| Real-Time Market Updates for Indian Investors | ✔ Monthly updates, WhatsApp alerts | ✘ No targeted updates or investor tools |

| Dubai Property Tours from India | ✔ Trips & property events organized for Indian buyers | ✘ Not offered or very limited |

Alfa Orbit is more than just a real estate agency — it's your personal property advisor in Dubai, built with Indian buyers in mind.

Conclusion – Is 2025 the Right Time for Indians to Invest in Dubai?

Absolutely. With high ROI, tax-free income, affordable luxury, and a robust legal system, Dubai is calling. Indian investors have never had a better opportunity to own prime real estate in one of the world’s fastest-growing cities.

Whether you're planning to move, rent out, or diversify your portfolio — 2025 is the year to make it happen. And with a reliable partner like Alfa Orbit, your Dubai dream is just a click away.

FAQs

1. What is the minimum investment required for Indians to buy property in Dubai?

Most properties start at around AED 500,000 (INR 1.1 Crore), but prices vary based on location and property type.

2. Can Indian citizens get a residence visa by investing in Dubai real estate?

Yes! A property worth AED 750,000 or more can qualify you for a renewable 2-year residence visa.

3. Is it legal for Indians to buy property in Dubai?

Absolutely. Indians are allowed to fully own properties in freehold zones across Dubai.

4. How long does the property buying process take in Dubai?

Once you choose a property, it can take as little as 7-10 days to complete the transaction and receive the title deed.

5. Which is better for Indian investors – off-plan or ready-to-move-in properties?

Off-plan is great for capital growth, while ready homes are better for immediate rental income. It depends on your strategy.